I run my consulting business almost exclusively with crypto: invoice clients, pay suppliers, track expenses, and pay taxes. Almost all of my company’s financial transactions happen onchain. Crypto saves me time, reduces costs, and expands my addressable market. But I never use Bitcoin to manage operations.

I use stablecoins: crypto tokens pegged to the US dollar or Euro, running on Ethereum or Ethereum-aligned chains like Base, Gnosis Chain, or Arbitrum.

Stablecoins, what Stripe calls “room-temperature superconductors for financial services,” are fast becoming crypto’s dominant use case.

Faster, cheaper, widely available, and censorship-resistant. What’s not to love?

Practical Crypto for My Business

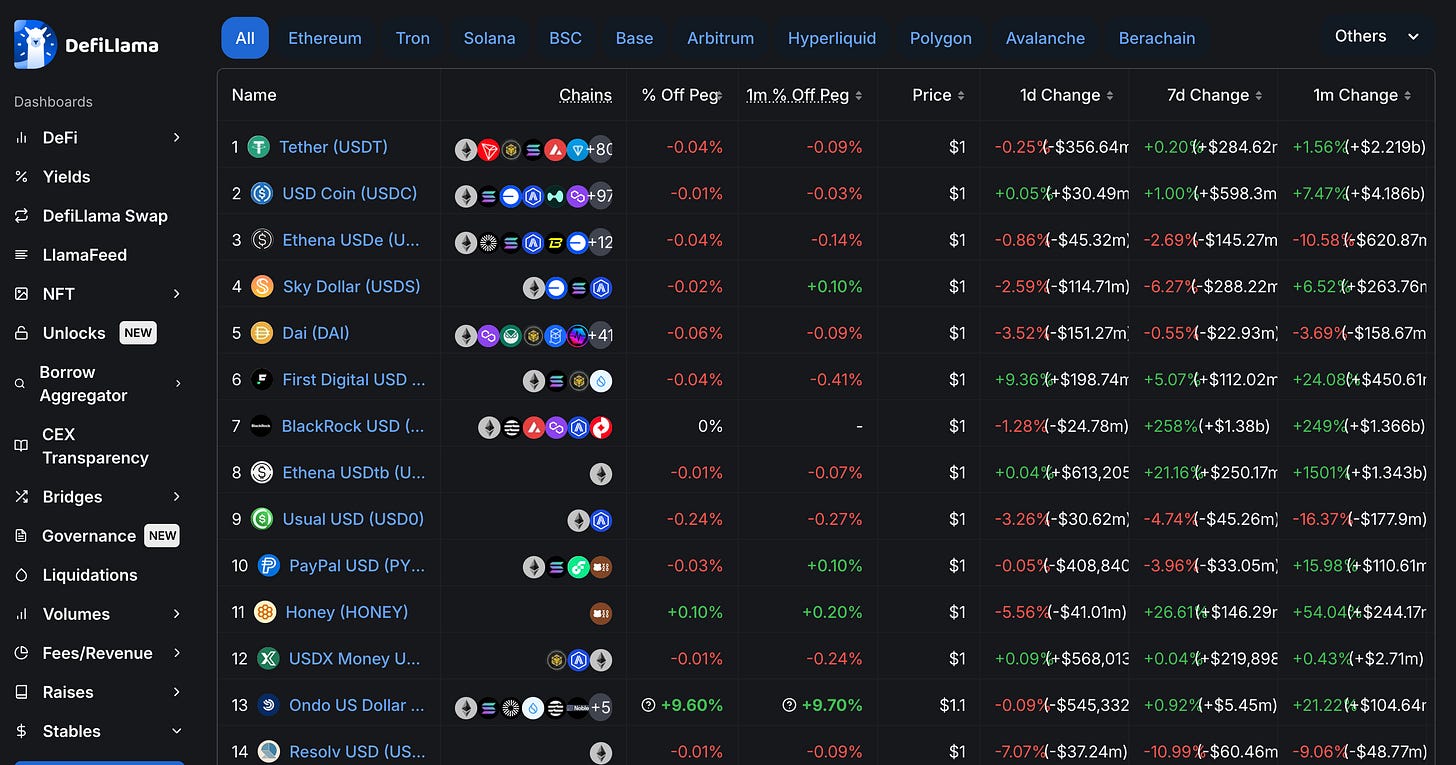

Which stablecoins do I use in my business? There are hundreds of possible stablecoins, each with slightly different characteristics: some are decentralized, some are yield-bearing, some backed by “Real World Assets” (RWAs) such as US treasuries, etc.

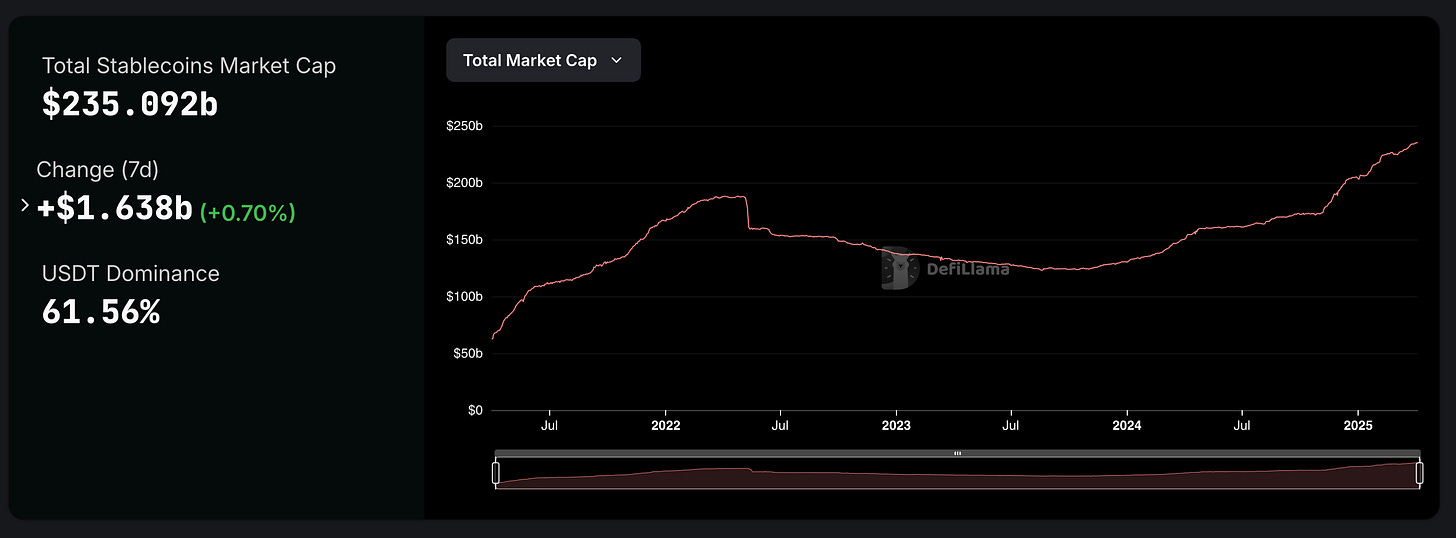

DefiLlama is a great resource to monitor stablecoin usage across all major blockchains:

For my EU-based business, I primarily use the following:

EURe, a MiCA-compliant, EUR-denominated stablecoin from Monerium. I invoice in Euros, and most of my business expenses are paid in EUR. I needed a widely accepted stablecoin linked to the Euro. EURe was the perfect choice.

USDC from Circle, USD-based, the second largest stablecoin by market cap, and the most used in decentralized finance (DeFi) applications onchain.

USDT from Tether. Much maligned, very centralized, but by far the market leader, so highly liquid. Tether is often preferred by freelancers, especially those based outside of the USA.

crvUSD. A more decentralized, dollar-based stablecoin, created by Curve. Curve is a swap/lend platform and a major enabler of stablecoins across Ethereum DeFi.

I use stablecoins to do just about everything for my business. I only move to fiat when forced. Primary use cases include:

Invoicing clients. More and more clients pay in crypto. Accepting stablecoins is especially beneficial for freelancers. You simply replace your bank account details on your invoice with your wallet account address. You will never again have to wait “3-5 business days” for payments to reach your bank or pay onerous fees just to accept an “international wire.” And you never have to ask if the funds were sent, as it’s all onchain.

Paying suppliers. When you manage a small business, you often work with freelancers. Stablecoin transfer fees are pennies, regardless of whether you are sending 500 USD or 5 billion USD. Transaction times are measured in seconds.

Daily expenses. My onchain account is linked to a Visa debit card through Gnosis Pay. With my Gnosis Pay card, I can pay for software subscriptions, flights, hotels, restaurants, etc. While more of a hybrid solution (crypto + Visa), I have complete control of the onchain funds used with my Visa debit card, so no bank can freeze or block my account.

Earning yield on cash deposits. Ethereum-based applications like Aave, Fluid, Curve, and Morpho are great ways to earn interest income on your stablecoins. Aave today has over 19 billion USD in crypto deposits, comparable to a large bank!

Off-ramping to my corporate bank using Monerium. I can send stablecoins (converted fiat) to my business bank account with just a few clicks.

Tracking Profit/Loss. Financial and tax accounting is crucial, especially when operating onchain. I use rotki, a privacy-enhanced, accounting and analytics tool. Rotki helps track and categorize all of my onchain transactions.

Banks are slower, fees are higher, and of course I’m alway at risk of having company funds frozen.

My corporate bank treats any transaction over a few thousand Euros as criminal until I can “prove” innocence. I often need to show invoices, financial statements, and business contracts to access my own funds!

Banks are not there to help but to monitor and control. Governments have privatized mass surveillance through the banking industry. But now we have other options.

With crypto, I have easy access to global contractors—videographers in Latvia, content writers in Africa, and front-end developers in Vietnam— who are happy to accept stablecoins for their work.

Bitcoin is not for Payments

Bitcoin gets all the hype but has very little practical use. BTC, “digital gold,” has value for wealth preservation, but who uses gold to manage daily business operations?

People looking for practical ways to use crypto often start by researching BTC because that’s what they see everywhere in the media. Bitcoin was the first cryptocurrency and is still the largest by market cap. So it must be the most useful for your business, right?

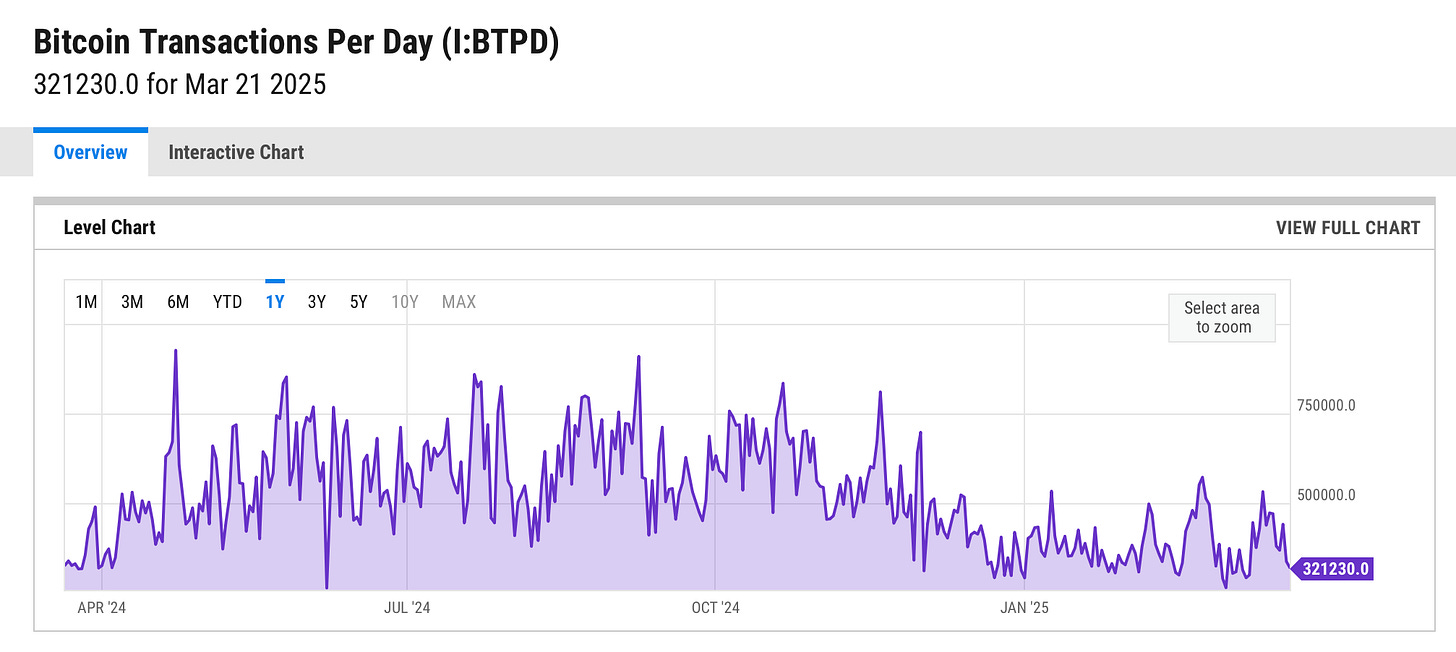

No. And the data clearly shows how insignificant BTC has become as a practical payment solution. Transactions over the Bitcoin network remain flat or falling. You can buy and hold Bitcoin, but how does that help you manage your growing business?

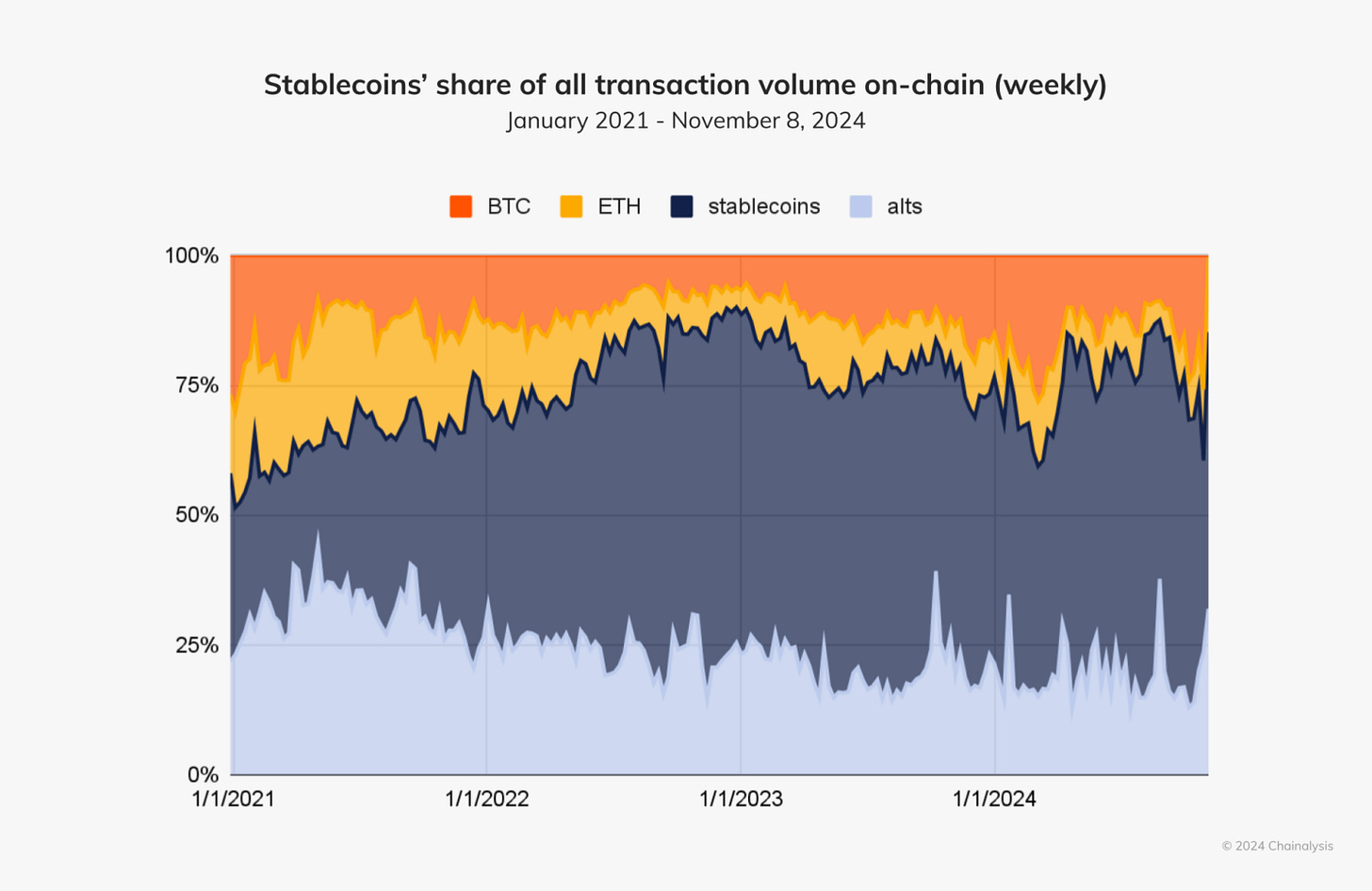

Stablecoins dominate global crypto payments, dwarfing BTC volume. According to Chainalysis, stablecoins accounted for over two-thirds of the trillions of dollars in cryptocurrency transactions recorded in recent months. A report by Coinbase noted that in 2023, stablecoins settled approximately $10.8 trillion in transactions, with $2.3 trillion attributed to organic activities such as payments and cross-border remittances.

Why are stablecoins exploding while BTC volumes remain flat or falling? Convenience! When I negotiate with clients or suppliers, I do it in USD or EUR. The fact we’ll settle onchain is a secondary issue.

On the other hand, introducing BTC into business discussions adds unnecessary friction. Major issues include:

Price volatility, especially when there is a large time gap between price negotiations and final payment. Who wants that risk?

Accounting challenges. My tax accountant is fine with stablecoins. He can process transactions easily (e.g., 1 EURe = 1 EUR). But Bitcoin transfers require complex P/L calculations, which are a mess. This takes extra time and adds admin costs.

Complex cash forecasting. With stablecoins, you never have to worry about cash in the bank. With BTC, you often need to hedge your positions. Or sell, forcing you to use a centralized exchange, adding additional costs.

Suppliers just don’t want BTC! They want dollars or Euros. Freelancers are typically familiar with stablecoins; many already have EVM-enabled crypto wallets. Blockchains are just a faster, cheaper way to process payments.

Challenges with Stablecoins

Cheaper, faster, with infinite options. So why aren’t more people, especially small businesses, rushing to use stablecoins? Unfortunately, there are still a number of issues that slow mass adoption, including:

Ignorance

Poor UX

Lack of regulatory clarity

The need to self-custody

Most people just don’t understand how prevalent stablecoins have become, especially in developing regions where banks are egregious in charging fees and harassing users.

Neobanks like Wise and Revolut are also an option, but transfer times are not necessarily instantaneous, international wires can be denied or put on hold, and users must KYC, making it a privacy nightmare.

Onboarding into crypto can also be challenging, especially if you are unfamiliar with the infinite number of blockchains, wallets, and onchain applications. With decentralized finance, customer support is non-existent, which can be a problem for new users.

Regulations are also unclear, even contradictory, and vary by region. Governments view stablecoins as a threat to monetary sovereignty. Blockchains hinder the state’s insatiable need to monitor and control its citizens. Fortunately, the massive increase in stablecoin usage is forcing more governments to accept them as a viable payment option, albeit begrudgingly.

When you eliminate the bank, you reduce time, costs, and friction. But you also become responsible for securing your own assets, something that is not trivial, especially for novices. Self-custody is hard, and mistakes can be catastrophic.

Centralized services are ready to help users manage their crypto. Exchanges like Coinbase, Binance, and Kraken, or payment services like Stripe and PayPal, are quite happy to facilitate stablecoin transactions for their users for a hefty fee. Sadly, this just moves control back to large financial institutions. Things change just enough to stay the same…

Stablecoin Market Cap to $1 Trillion in 2026?

As I write this in April 2025, financial markets are reeling from Trump tariffs, but stablecoin adoption remains up only:

I believe we’re 18 months away from stablecoins reaching a total market cap of $1 trillion. More businesses will embrace stablecoins to reduce costs and expand market reach; more consumers will adopt stablecoins for cross-border payments and money transfers. New entrants like BlackRock with their BUIDL fund will accelerate growth.

Stablecoins are crypto’s killer use case, but you won’t find stablecoins on Bitcoin. Ethereum and EVM chains dominate the stablecoin market.

The sooner we move beyond Bitcoin, the faster we’ll embrace practical crypto solutions on Ethereum and other smart-contract-enabled blockchains. And see the real benefits of decentralized finance.